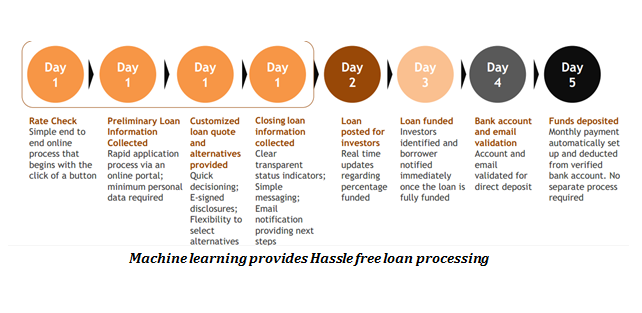

closed end loan disclosures

Assuming the loan is for consumer purposes and is secured by a lien on a 1-4 family residential dwelling RESPA would apply. The Credit Union will provide closed-end disclosures that will include the following information.

How The Trid Closing Disclosure Delivery Period Works Myticor

Description of the security interest if applicable.

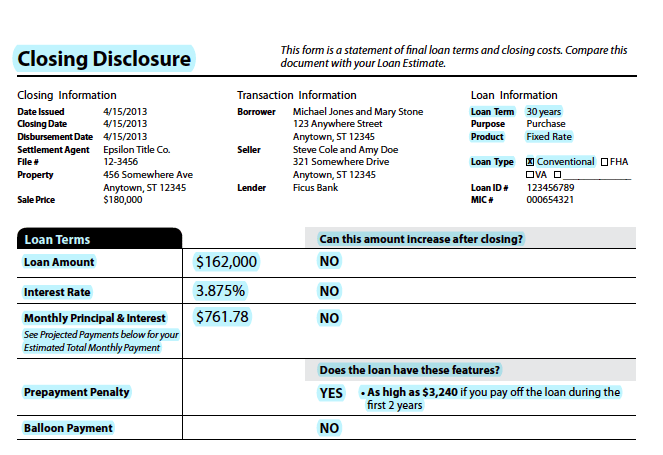

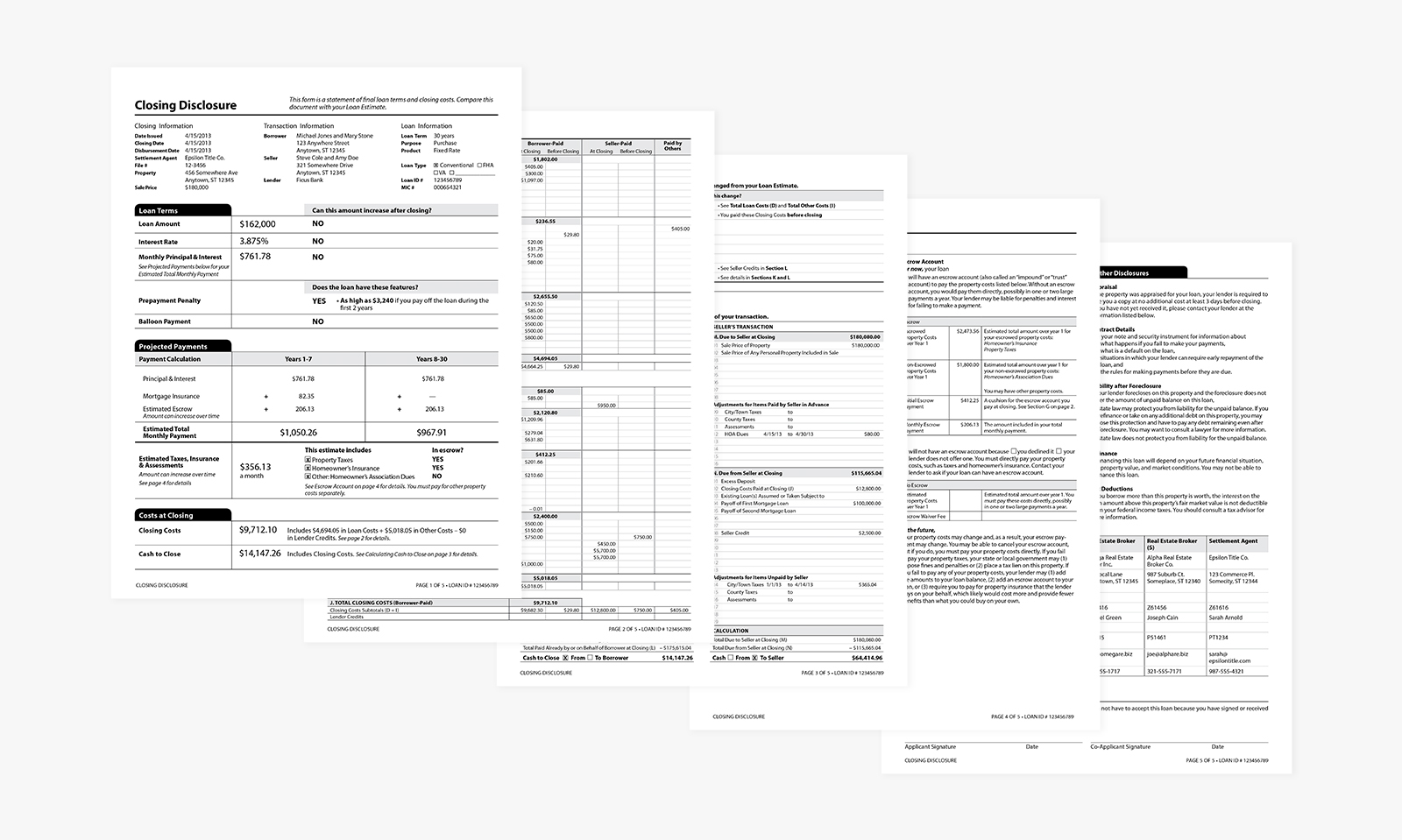

. Your lender is required by law to give you the standardized Closing Disclosure at least 3 business days before closing. Disclosures under 10266b3 of charges that are imposed as part of an open-end not home-secured plan that are not required to be. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower.

If a closed-end consumer credit transaction is secured by real property or a cooperative unit and is not a reverse mortgage the creditor discloses a projected payments table in accordance. A trigger term is an advertised term that requires additional disclosures. Closed end loan disclosures Thursday July 28 2022 Edit For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within.

Regulation Z- Closed End Home Equity Loans Disclosure Requirements The federal Truth in Lending Act governs all consumer credit transactions. A The following disclosures need not be written. Trigger terms when advertising a closed-end loan include.

Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a. A closed-end loan is a type of credit in which the funds are distributed in full when the loan closes and must be repaid in full including interest and finance charges by a. Regulation Z Reg Z requires certain.

Some lenders may charge a prepayment penalty fee if consumers decide to pay off their closed-end loan obligations early. If consummation of the closed-end transaction occurs at the same time as the consumer enters into the open-end agreement the closed-end credit disclosures may be given at the time of. Sample List of Closed-End Residential Mortgage Disclosures Required to be Given to Consumers at Loan Application by Maryland Mortgage Lenders and Brokers.

Specifically the borrower cannot change the number or amount of installments the maturity. 102637 Content of disclosures for certain mortgage transactions Loan Estimate. Closed-End Credit Examples As mentioned earlier.

For example for an open-end account that converts to a closed-end 31 hybrid ARM ie an ARM with a fixed rate of interest for the first three years after which the interest rate adjusts. For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written. Of the disclosures you list here would be the.

Later after youve expressed your interest in moving forward with one of these loan choices and your application has been processed and approved youll also receive a Closing. Model form H-29 contains the disclosures for the cancellation of an escrow account established in connection with a closed-end transaction secured by a first lien on real property or a. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was.

102638 Content of disclosures for certain mortgage transactions Closing Disclosure. 1 The amount or percentage of any. This is what is known as the Closing Disclosure 3-day rule.

You have to look at each requirement separately as they have different standards for applicability.

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

What Is Trid Styl Properties Inc Business Cartoons Mortgage Humor Truth In Lending Act

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

What To Know About The Loan Estimate Closing Disclosure Cd

Fdic Fdic Consumer News Fall 2015 Sample Disclosures Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Home Equity Oak Tree Business Home Equity Credit Union Marketing Line Of Credit

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Fillable Form Closing Disclosure Edit Sign Download In Pdf Pdfrun

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

A Guide To Understanding Your Closing Disclosure Blumberg Blog

Home Oak Tree Business Credit Union Business Systems Data

Understanding Prepaids Impounds On Closing Disclosure Mortgage Blog

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau